Where tariffs stand after months of chaos

Tariff mania is still ongoing, but it’s come to somewhat of a crescendo as August rolls in. Here’s a high-level overview of where things stand now.

By Austin Payne

/

Published 8.4.2025

Back in April, a wave of tariff threats from the Trump administration triggered one of the sharpest market plunges in recent history, a $6 trillion selloff that rattled investors, economists, and global allies alike. The S&P 500 dropped nearly 19% from its peak, small caps cratered, and predictions of a recession surged overnight.

After Trump quickly pivoted to a 90-day pause on the most sweeping tariffs, early signs of bilateral deals helped spark a fast rebound by May: The Nasdaq surged, the S&P regained ground, and markets settled into a fragile but hopeful calm. That uncertainty has continued, but ongoing discussions over the past few months have largely kept markets optimistic, even if consumers have been disoriented.

To bring some clarity to this chaos, here’s a brief summary of how things stand, now that we’re in August:

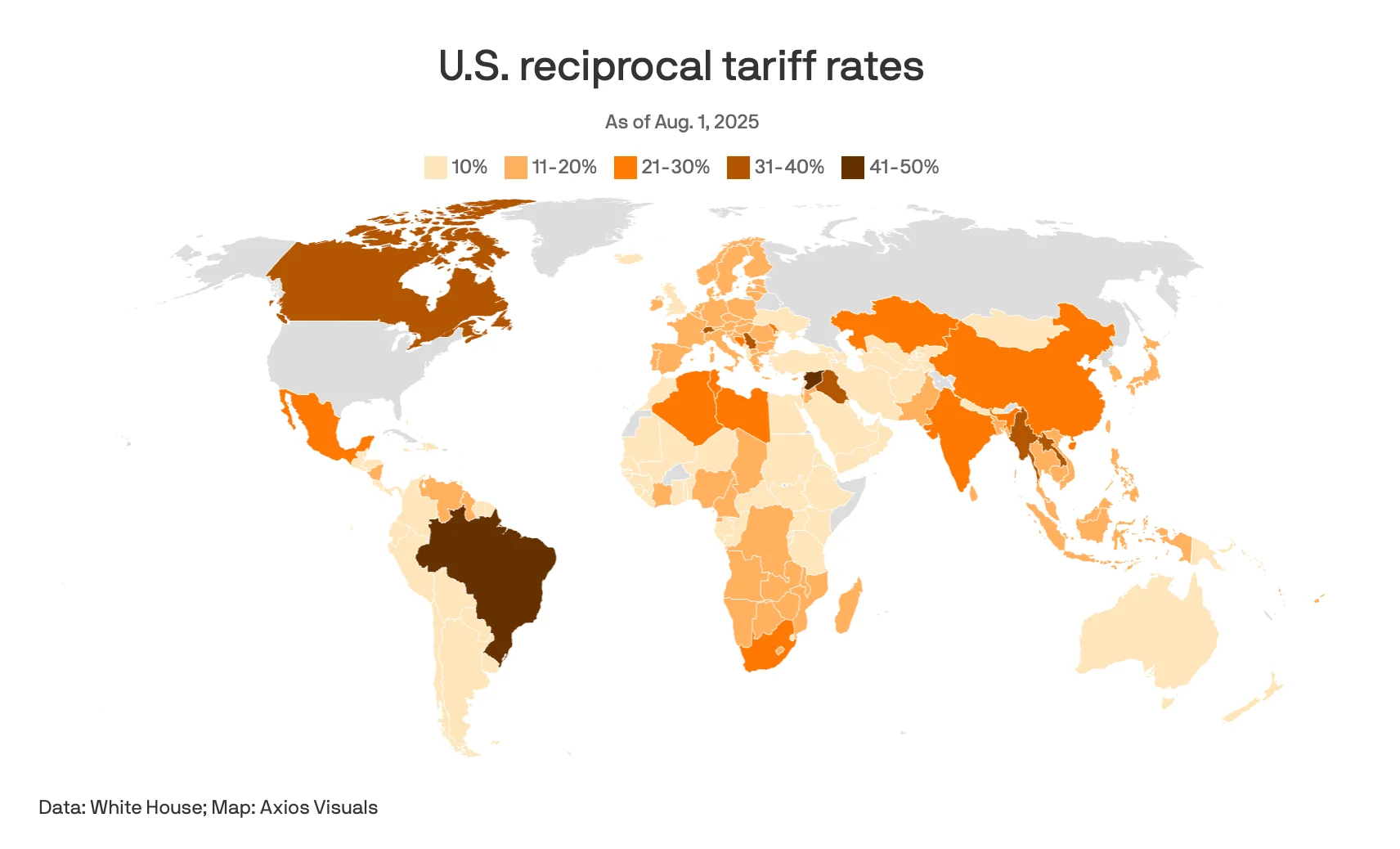

Most countries now fall into a three-tier system: 10% for surplus or neutral partners, 15% for those the administration views as having less favorable trade terms, and 25–50% for nations with unresolved disputes or diplomatic friction. The baseline rate is 10%, but nearly all major partners are now above that threshold.

Canada & Mexico: Canada’s rate jumped to 35% as of August 1, while Mexico secured a 90-day extension at its existing 25% rate; both retain USMCA exemptions for covered goods like autos (or auto parts) and agricultural products (like dairy or beef).

Japan & EU: Japan’s finalized deal sets tariffs at 15% and includes a $550 billion investment pledge. The EU is nearing a similar 15% agreement with key carve-outs, though negotiations are still in progress.

India & Brazil: India was hit with a 25% tariff plus a penalty over Russia ties and trade barriers; Brazil faces the steepest penalty yet at 50%, tied to political disputes.

China is still in a 90-day truce through August 12, with temporary reductions to 10%. The baseline remains at 30% if no deal is reached soon.

Other countries: The U.K., Vietnam, Indonesia, and the Philippines struck deals in the 10–20% range, while Switzerland, Cameroon, and others are facing unexpected hikes.

The Treasury Department reports that the US took in around $28 billion of tariff revenue during the month of July, with estimates of total revenue over the next decade varying wildly due to the uncertainty around these levies right now. As a result, Trump has floated the idea of sending “Tariff Rebate” checks to Americans (instead of cutting the deficit), and Senator Josh Hawley even introduced a bill to back it, allocating $600 per person.

Source: Axios

The average U.S. tariff rate now sits at 18.3% — the highest level since 1934 — and the Yale Budget Lab estimates the new regime will cost the typical American household around $2,400 this year, even after accounting for substitution effects. Inflationary pressure is beginning to surface in everyday categories like appliances, furniture, toys, and clothing. Meanwhile, legal uncertainty looms: A federal appeals court is weighing whether Trump has the authority to impose such sweeping trade measures under emergency powers (as he claims), and the case is widely expected to make its way to the Supreme Court.

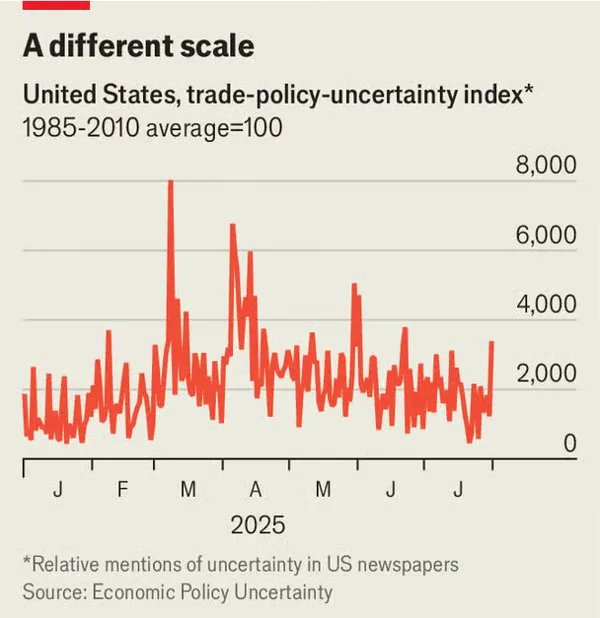

As you might surmise, he overarching theme here is that of uncertainty — we’ve used that word four times in this topic already — and yes, it’s measurable. Economic Policy Uncertainty actually monitors mentions of policy-related economic uncertainty across American newspapers, and we’re well above the average right now.

Source: The Economist

Overall, markets have mostly stabilized, but the full economic impact of Trump’s trade reset may still be unfolding — and August’s implementation window leaves little time for remaining holdouts to avoid a harsher default.

Want more insights like this delivered to your inbox? Sign up for our newsletter below ⬇️