Buying vs. Leasing a Car

Is it better to lease or buy a car? There are pros and cons to both. Let's dive in.

Thinking about buying a new car? Maybe your current one is on its last leg. Or maybe you need something that gets better gas mileage. In any case, is it better to lease a car or buy one? There are advantages to both, so it’s worth considering both options.

What’s the difference?

Leasing is essentially renting a car for a designated period (usually 3-5 years) and giving it back at the end of the lease. Buying is paying cash or financing (making monthly payments) and you own the vehicle.

Factors to Consider

As with any purchase, the major factor to consider is cost. With a vehicle, there is the monthly cost as well as the overall cost. The monthly costs include your payment if you lease or finance, and your insurance premium. The overall costs are the down payment, repairs, depreciation and fees.

Monthly Payments

If you’re looking for the lowest monthly payment, leasing is probably your best bet because lease payments are based on residual value (value after depreciation during the lease period). The lower monthly payments don’t come without a consequence, however. Remember that once the lease is up, you can either purchase the vehicle or give it back and get another one.

Either way, you’ll continue with payments. With purchasing, the monthly cost will probably be higher, but the advantage here is that at the end of loan, you will own the car and your payments will stop.

Insurance

The insurance costs will be the same whether you buy or lease. Financing companies will have minimum limits you need to carry on your new vehicle. If you’re buying with a low down payment or you’re leasing, it’s a good idea to ask about gap insurance so you’re not left footing the bill if the car were to be totaled in an accident.

Down Payment

The down payment on a car is more flexible than the down payment for a home. There usually isn’t a required percentage down, though, the more you put down, the lower your monthly payments will be (be careful of tying up cash in a depreciating asset, however). The actual amount of cash you’ll need for the down payment can depend on several things including your credit score. For example, someone with a low credit score who wants to finance a more expensive vehicle would likely have to come up with a larger down payment.

Leasing may also require significant upfront costs, including the first month’s payment and a down payment — especially if you’re interested in negotiating the lowest possible monthly payment. Leasing can be a cost-effective alternative to car buying, but remember that you’re putting down cash toward something you won’t own. Because of this, you’ll want to consider keeping your down payment as low as possible.

Maintenance and Repairs

Maintenance and repair costs affect both lessees and buyers. Some dealers will offer free oil changes, but you will still be responsible for ongoing maintenance, tire replacement, etc. If you lease, your maintenance costs will be lower because your lease will be up while the car is relatively new. If you purchase, keep in mind that as cars age, their maintenance and repairs can be significant. Include some padding in your budget for these expenses.

Depreciation

You’ve heard the adage that a car depreciates the second you drive it off the lot. And the more you drive, the faster it depreciates, which is an even bigger drawback for a lease. Leases cap your annual mileage at anywhere from 12,000 to 15,000 miles, with a per-mile penalty if you go over.

Which one is Cheaper?

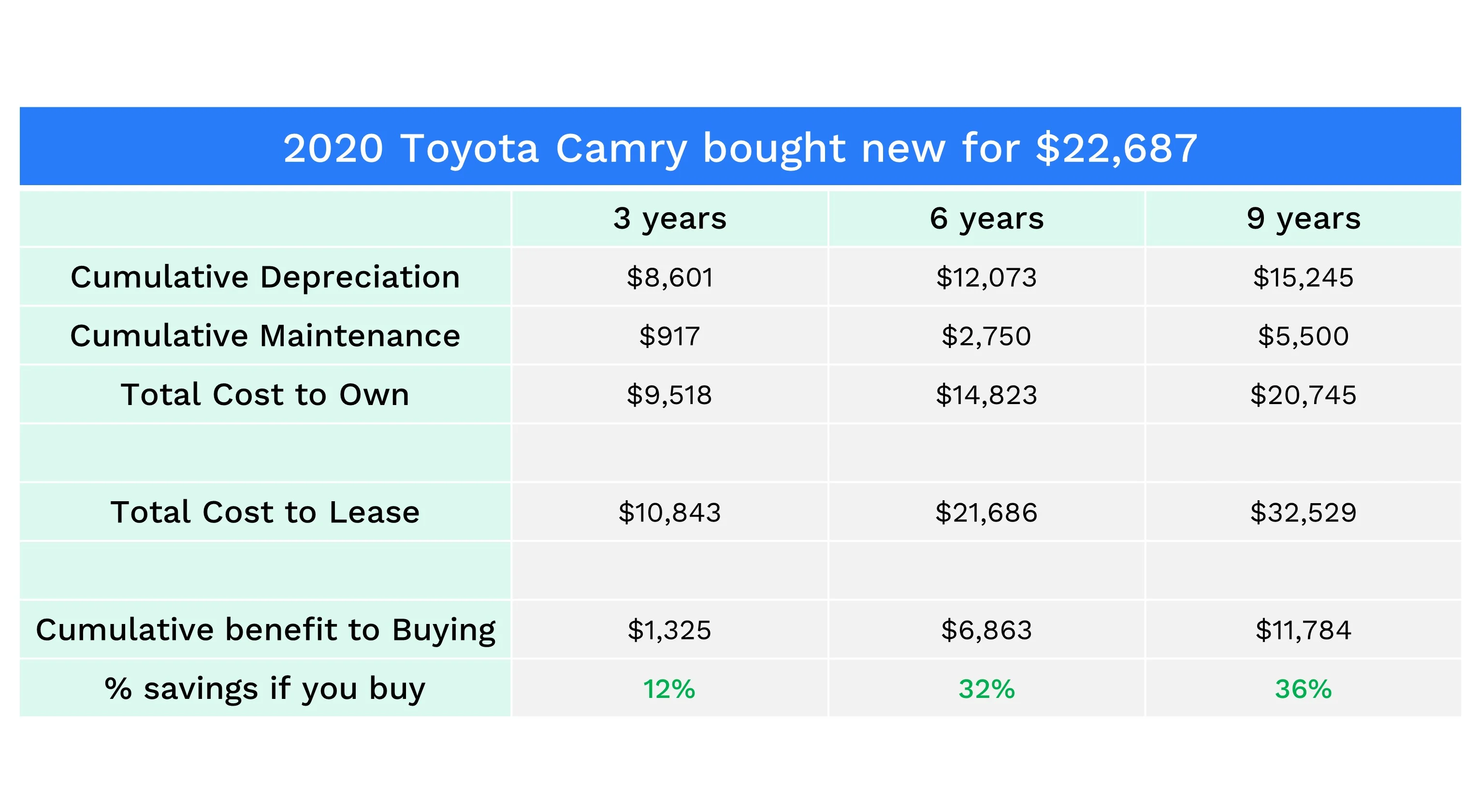

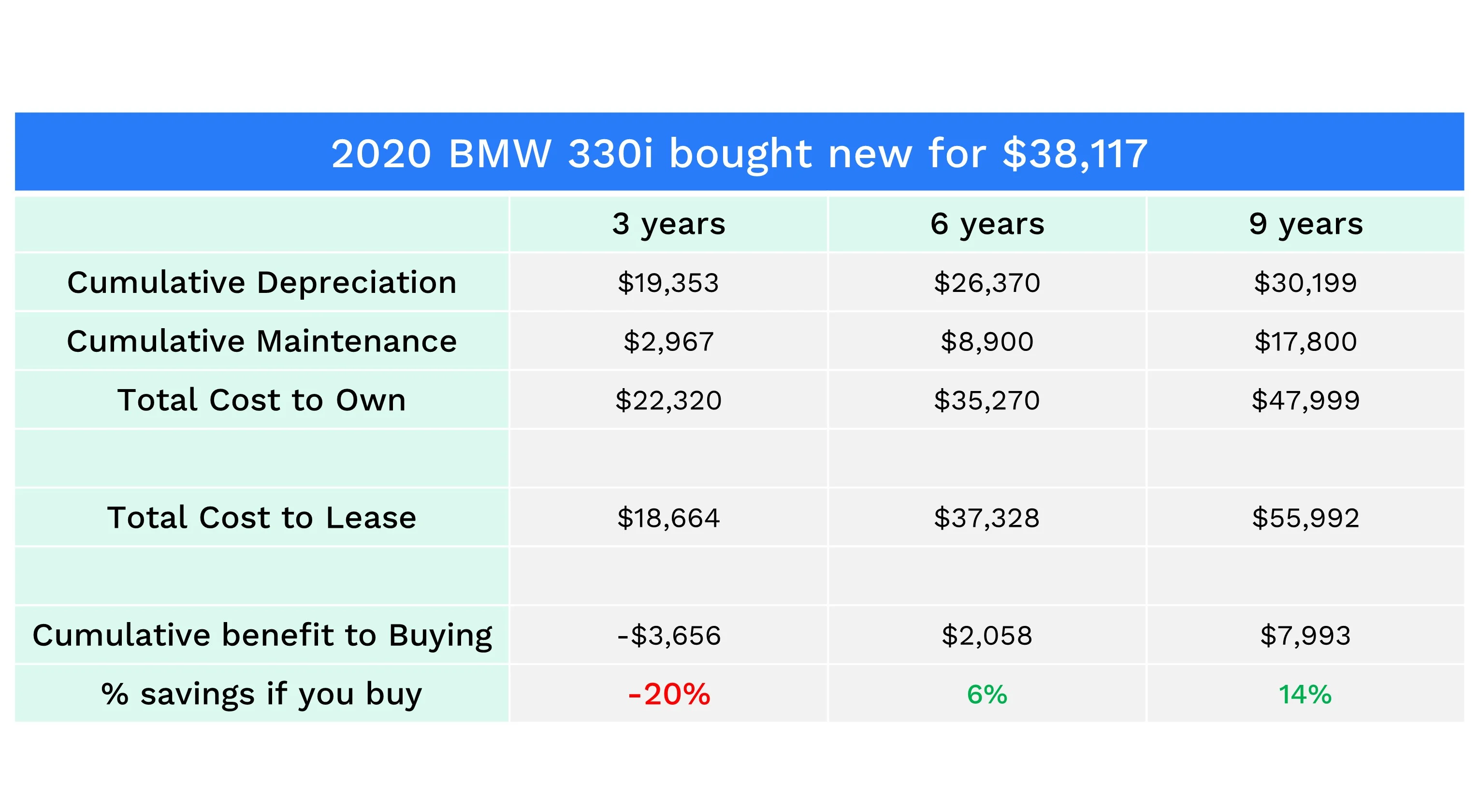

To test this, we went to Kelley Blue Book to look up prices of new and used (3, 6, and 9 year old) Toyota Camry and BMW 3-series sedans and maintenance estimates. We compared those prices to Toyota and BMW 3-year lease deals from the manufacturer (and assumed maintenance was included). We assumed that if you lease for 9 years you get 3, 3-year back-to-back leases at the same rate. We assumed gas, insurance, and state fees were similar in both cases, and left those costs off.

We threw all the numbers into a chart to see if buying versus leasing is cheaper over a 3, 6, or 9 year time horizon for both cars. As you can see below, buying is cheaper in most cases!

So what should I do?

In many cases, buying will make the most sense. Buying a car and keeping it after you’ve paid it off is the most cost-effective. Remember, in most places you’re going to keep needing to buy a new vehicle every 8-10 years (and if you’re a family needing 2 vehicles, every 4-5 years), so it’s important to be as efficient and cost-effective as possible.

If I buy, should I finance or pay in full?

Generally, we like the discipline that comes with paying for a vehicle in full. You don’t run the risk of living in excess of your means if you literally only buy what you can afford. If you finance, aim for interest rates between 0-3%. Four to five percent interest rates aren’t a deal breaker, but over 5% is pretty painful. If your interest rate is over 4 or 5%, consider saving for a larger down payment or getting a cheaper vehicle.

Buying or leasing a vehicle is a personal choice. Most of the time, buying is the most cost efficient option. If you prefer to have a newer car with little to no maintenance and are ok with always having a payment, you could lease. Be sure to consider all your options before taking the jump!